Customer Lifetime Value (CLV or CLTV) | KPI Deep Dive

Company X: A Case of CLV Gone Wrong

Let’s consider Company X, an e-commerce business. They spend a lot on advertising and acquisition to get new customers but don’t focus enough on retaining them. As a result, their CLV is much lower than expected and falling.

Customer Lifetime Value (CLV) is a critical metric in the world of marketing. It helps businesses understand how valuable each customer is over the entire time they do business together. Let’s explore what CLV is, why it’s crucial, how it relates to other key performance indicators (KPIs), and how to calculate and improve it.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value, or CLV for short, is a number that tells a business how much money, on average, they can expect to earn from a single customer during the entire period that customer continues to buy from them.

Where is it Used?

CLV is used in various parts of a business. Marketing teams use it to decide how much they can spend to acquire new customers. Customer service teams use it to determine how to best serve high-value customers. Finance teams use it to assess the long-term financial health of the company.

Why is Customer Lifetime Value (CLV) Important?

CLV is vital because it’s a KPI that magnifies. Any increase in average customer value is an increase over the entire customer base. Case-in-point: if you can increase Customer Lifetime Value by just $10 over the life of a customer, and you have a customer base of 20,000, then you’re effectively increasing your revenue for your existing customers by $200,000 ($10/customer x 20,000 customers)!

On a customer level, it helps businesses make decisions about where to focus their efforts and resources. It costs money to acquire new customers, and CLV helps determine if those acquisition costs are worth it. It also guides efforts to retain and delight existing customers.

We focus on CLTV because it can be an easier KPI to focus on. As you’ll see below, there are three parts to the equation, and different groups within the company can focus on each. When the entire company gets behind a push to improve Customer Lifetime Value, it can quickly turn a fledgling business into a rocketship!

How Does CLV Relate to Other KPIs?

CLV is closely related to several other KPIs:

– Customer Acquisition Cost (CAC): CLV helps to assess whether the cost of acquiring a customer is justified by the revenue they will generate over their lifetime.

– Churn Rate: High churn rates can significantly impact CLV, as it means customers are leaving sooner, reducing their overall value.

– Conversion Rate: Improving conversion rates can lead to higher CLV, as more leads become customers.

What Metrics Do You Need to Calculate Customer Lifetime Value (CLV)?

To calculate CLV, you need three primary metrics:

1. Average Purchase Value: The average amount a customer spends on a purchase.

2. Average Purchase Frequency: How often, on average, a customer makes a purchase.

3. Customer Lifespan: The average number of years a customer continues to buy from your company.

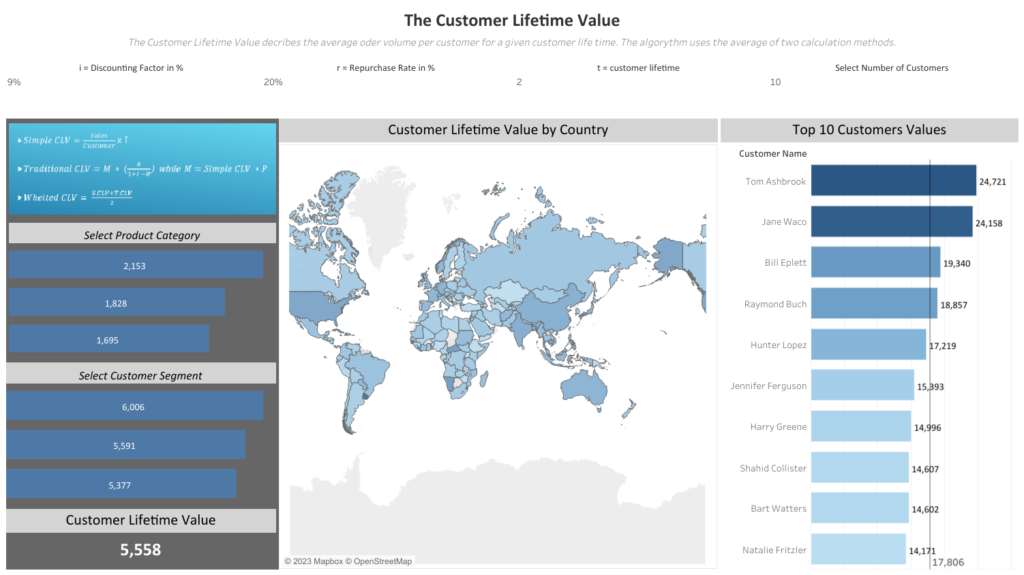

How is Customer Lifetime Value (CLV) Calculated?

The formula for CLV is simple:

CLV = Average Purchase Value x Average Purchase Frequency x Customer Lifespan

This calculation provides an estimate of the total revenue a customer is expected to generate over their entire relationship with your business.

How Can A Company Improve Customer Lifetime Value (CLV)?

Improving CLV involves focusing on the customer experience and long-term relationships. There are inherently three aspects to it that a company can focus on: how much customers spend per transaction, how often they buy, and how long they remain customers. Here are a few ways to improve CLTV:

1. Provide Excellent Customer Service: Happy customers are more likely to return.

2. Offer Personalization: Tailoring offers and communication to individual preferences can boost loyalty.

3. Upselling and Cross-selling: Recommend relevant additional products or services. Increasing the average order value inherently increases CLTV.

4. Loyalty Programs: Reward customers for repeat business.

5. Retention Marketing: Create campaigns that specifically target existing customers.

What Should Company X Change to Improve CLV?

Returning to Company X, and their crazy-high CLV. They should shift their strategy:

1. Customer Retention: Invest in strategies to keep existing customers engaged and satisfied. The longer the average customer lifespan, the more revenue you expect to get from the average customer.

2. Loyalty Programs: Introduce customer loyalty programs to reward repeat customers. Rewarding loyal customers can turn relatively disgruntled customers (those with low Net Promoter Scores, as we talk about here) into referrers (that we walk through here).

3. Data Analysis: Analyze customer data to identify trends and preferences, enabling better targeting and personalization.

4. Customer Feedback: Act on customer feedback to improve the overall shopping experience. When customers feel heard, it improves the overall customer relationship.

5. Customer Support: Improve customer support to resolve issues promptly and effectively. To add onto the Loyalty Programs point above, the higher your customer satisfaction scores, the more likely it is that they’ll refer you to prospective customers. And lowering customer acquisition costs is a HUGE in marketing (as we talk about here).

In conclusion, Customer Lifetime Value (CLV) is a crucial metric that helps businesses understand the long-term value of their customers. By calculating and improving CLV, businesses can make informed decisions, allocate resources more effectively, and build stronger customer relationships. Company X, like many others, can benefit greatly from a shift toward customer-centric strategies to improve their CLV and overall business success.